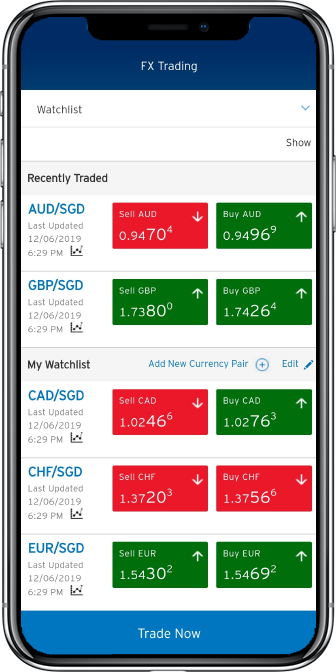

Watchlist with Live Rates

Convert currencies on the go with Citi Mobile® App or Citibank Online and personalise your watchlist with live-streaming FX rates.

Instantly access foreign exchange rates with spot trades. Place limit orders to execute your trade when the exchange rate matches your desired rate with Order Watch. Access FX charts, polls, and receive rate alerts on-the-go, now with Citibank Online Foreign Exchange (eFX).

Our platform trades in the following currencies: SGD, USD, EUR, GBP, NZD, HKD, CAD, AUD, CHF, JPY, AED, DKK, NOK, SEK and ZAR.

Citi FX Calculator

Click Here To Try Now

Let us assist you through a host of benefits and innovative trading services as your foreign exchange needs evolve.

Convert currencies on the go with Citi Mobile® App or Citibank Online and personalise your watchlist with live-streaming FX rates.

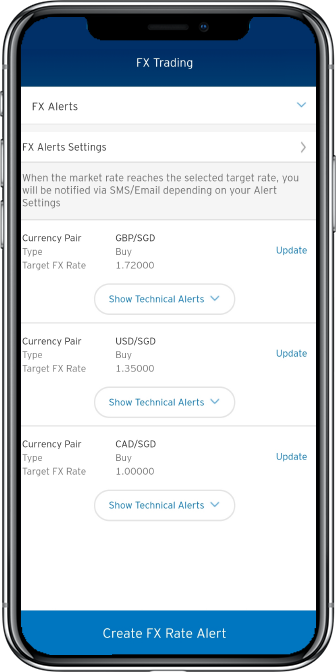

Get notified immediately through SMS or email alerts when your preferred currency reaches the desired rate, and start trading.

Automated buy or sell a currency once it has reached your desired rate.

Gain insights by viewing a market consensus of your preferred currencies.

Thomson Reuters provides you with charts and analysis to help identify FX market trends. Receive alerts when technical indicators reach your pre-defined levels.

Enjoy instant access to multiple currencies and make payments when overseas or to online merchants with your Citibank Debit Mastercard.

Enjoy free withdrawals at any Citibank ATMs worldwide from your Foreign Currency Account with Citibank Debit Mastercard.

No surprises on hidden or 3rd party fees when you spend overseas or shop online. Have full control of your FX rates and enjoy greater transparency on overseas transactions.

Transfer funds online between your Citibank accounts globally. It is easy to use, faster and more cost-effective than traditional Telegraphic Transfer (TT).

With Citi’s eFX,

you get to shop and pay in local currency at your desired locked-in rates.

Want to pay in foreign currency but afraid of steep exchange rates?

Exchange foreign currencies at attractive rates with Citi eFX, and settle point-of-sale or online payments with your Citibank Debit Card.

Prevent currency exchange losses on your international investment portfolios by having your funds deposited into a foreign currency account. With Citi eFX, tap into analytical and rate alert tools to help you make informed decisions.

Never miss out on trade opportunities as we watch the markets for you.

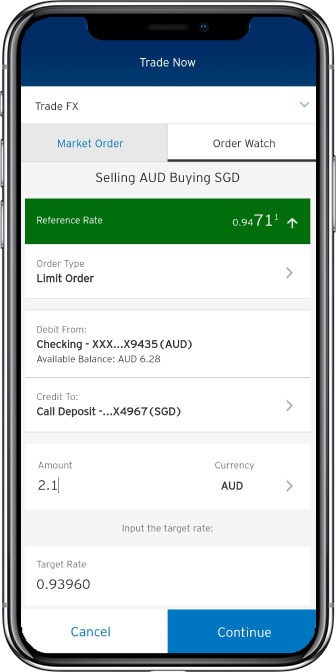

With Citi eFX’s Order Watch, have your desired foreign currency purchased and executed automatically once your target rate is reached.

Be equipped with tools to help you make informed trading decisions.

FX charts and technical indicators provide you with insights to past historical FX levels and help you determine your take profit or stop-loss levels.

Interested to find out market expert commentaries on future FX movements?

With FX Polls, you can gain insights by viewing the market consensus of your preferred currencies.

Witi Citi eFX, set your desired foreign exchange rate with Order Watch and let eFX auto execute the order when the market rate matches your desired rate. With the exchanged amount, remit overseas to family members, friends, business partners or other Citi accounts globally without any hassle and worry about fluctuating exchange rates.

Get more value for your remittances by avoiding fluctuating exchange rates.

With Citi eFX’s Order Watch, we will help you convert foreign currencies automatically when markets reach your desired rates.

Transfer funds around the world from Citi Mobile® App or via Citibank Online. Transfer fees apply.

Transfer funds instantly from your Citibank checking, savings or money market accounts to your Citibank accounts anywhere in the world.

Act instantly when the pricing hits your desired level.

You can set up a preferred FX rate at which the Buy or Sell Order will be automatically executed.

Choose the currency pairs, set your target FX rates, and receive SMS or Email alerts when markets hit your desired FX rates.

Already have an account?

Click here to

get started.

Want to learn more about

Forex trading and forex markets? click here

Let us assist you through a host of benefits and innovative trading services as your foreign exchange needs evolve.

Get notified immediately through SMS or email alerts when your preferred currency reaches the desired rate, and start trading.

Instantly buy or sell a currency once it has reached your desired rate.

Gain insights by viewing a market consensus of your preferred currencies.

Thomson Reuters provides you with charts and analysis to help identify FX market trends. Receive alerts when technical indicators reach your pre-defined levels.

Transfer funds online between your Citibank accounts globally. It is easy to use, faster and more cost-effective than traditional Telegraphic Transfer (TT).

Let us assist you as your foreign exchange needs evolve through a host of benefits and innovative trading services.

Get notified immediately through SMS or email alerts when your preferred currency reaches the desired rate, and start trading.

Transfer funds online between your Citibank accounts globally. It is easy to use, faster and more cost-effective than traditional Telegraphic Transfer (TT).

With Citi Mobile® App's eFX features, you can instantly make currency conversions at your desired rates and make sure you have enough currency at hand.

Enjoy free withdrawals at any Citibank ATMs worldwide from your Foreign Currency Account with Citibank Debit Mastercard.

Enjoy instant access to 10 currencies and make payments when overseas or to online merchants with you Citibank Debit Mastercard.

Convert currencies on the go with Citi Mobile® App and personalise your watchlist with live-streaming FX rates.

Let us assist you as your foreign exchange needs evolve through a host of benefits and innovative trading services.

Get notified immediately through SMS or email alerts when your preferred currency reaches the desired rate, and start trading.

Instantly buy or sell a currency once it has reached your desired rate.

Gain insights by viewing a market consensus of your preferred currencies.

Thomson Reuters provides you with charts and analysis to help identify FX market trands. Receive alerts when technical indicators reach your pre-defined levels.

Transfer funds online between your Citibank accounts globally. It is easy to use, faster and more cost-effective than traditional Telegraphic Transer (TT).

With Citi Mobile® App's eFX features, you can instantly make currency conversions at your desired rates and make sure you have enough currency at hand.

Enjoy free withdrawals at any Citibank ATMs worldwide from your Foreign Currency Account with Citibank Debit Mastercard®.

Let us assist you as your foreign exchange needs evolve through a host of benefits and innovative trading services.

Gain insights by viewing a market consensus of you preferred currencies.

Instantly buy or sell a currency once it has reached your desired rate.

With Citi Mobile® App's eFX features, you can instantly make currency conversions at your desired rates and make sure you have enough currency at hand.

Enjoy free withdrawals at any Citibank ATMs worldwide from your Foreign Currency Account with Citibank Debit Mastercard®.

Get notified immediately through SMS or email alerts when your preferred currency reaches the desired rate, and start trading.

Convert currencies on the go with Citi Mobile® App and personalise your watchlist with live-streaming FX rates.

What is Citibank eFX?

Citibank eFX is an online platform that allows you to convert funds within your Citibank accounts into different foreign currencies.

What do I need in order to use Citibank eFX?

You will need to open a Global Foreign Currency Account for the foreign currencies that you would like to trade in. Alternatively, you can apply for an Overnight Deposit which serves as a deposit facility to store your foreign currencies.

Customers should be mindful of the regulations in their country of domicile with regards to engaging in FX transactions. Citibank eFX is made available to customers on a non-solicited basis.

What is an Overnight Deposit?

The Overnight Deposit is a deposit facility to store multiple currencies. This facility offers convenience to customers without a Global Foreign Currency Account by providing a debiting/crediting option for foreign currency transactions.

While the Overnight Deposit can be used for debiting or crediting purposes during an investment transaction or via Citi Online Foreign Exchange (eFX), it is not a transactional account and cannot be used for cash withdrawals, debit card payments or remittances. Balances in the Overnight Deposit may be non-interest bearing and can only be withdrawn by transferring to a Global Foreign Currency Account or Checking/Saving Account via Citibank Online.

Overnight Deposits are opened upon request when customers transact in Investment Products such as Time Deposit, Premium Account, Unit Trust, Portfolio Finance, etc.

Can I make a Citibank eFX transaction using the Overnight Deposits account as the source of funds?

Yes. You can select the Overnight Deposits account as the source of funds/debit account.

How do I transfer my Overnight Deposits account balance into a Global Foreign Currency account?

1. If you have an existing Global Foreign Currency Account that is in the same currency as your Overnight Deposit, you can transfer the balance in your Overnight Deposit account via "Payments and Transfers" in Citibank Online. Such transfer does not involve currency conversion.

2. If you do not have an existing Global Foreign Currency Account in a currency that is the same as your Overnight Deposit, you may choose to transfer the balance in your Overnight Deposit account by either using "Payments and Transfers" in Citibank Online or using eFX on the Citibank Mobile® App or Citibank Online. Please take note that such transfer involves currency conversion.

Are there any monthly maintenance fees for the Overnight Deposits account?

No, there is no administrative fee to open or maintain the Overnight Deposits account.

Where can I access Citibank eFX?

1. Citibank Online

This online service is available 24/7. Simply logon to www.citibank.com.sg to

access

Citibank eFX.

2. Citi Mobile® App

Trade and track your portfolio on the go! To do so, you will first need to

download the Citi Mobile® App from your Apple App or Google Play stores before logging in.

How do I open a Citibank Global Foreign Currency Account or register for Internet Banking?

1. Click here to apply for a Citibank Global Foreign Currency Account.

2. Register for Internet Banking on Citibank Online or on the Citi Mobile® App.

What is the Foreign Exchange Market and what are the trading hours?

The FX market is not traded on a regulated exchange like stocks and commodities, but rather a network of financial institutions and retail brokers. The FX market is available for trading 24 hours a day, five days per week.

Limit Orders: Order Watch service is not available at the following timings:

i. On weekdays (Mon to Fri), during system downtimes

11:00PM - 11:20PM

03:00AM - 07:00AM

ii. On gazetted public holidays in Singapore or Undited States

iii. On days when commercial banks and FX markets are not open for business in the country of your selected trading currency

Spot Orders: Available 24 hours a day, including Saturdays and Sundays. On Saturdays and Sundays, no live rates are available.

Which are the currencies that I can buy or sell?

Citibank eFX allows you to trade up to 15 different currencies:

1.USD United States Dollar

2.EUR Euro

3.JPY Japanese Dollar

4.GBP British Pound

5.SGD Singapore Dollar

6.HKD Hong Kong Dollar

7.AUD Australian Dollar

8.NZD New Zealand Dollar

9.CAD Canadian Dollar

10.CHF Swiss Franc Dollar

11. AED United Arab Emirates Dirham

12. DKK Danish Krone

13. NOK Norwegian Krone

14. SEK Swedish Krona

15. ZAR South African Rand

What are the types of orders available for eFX transactions?

You can place a Market Order, Limit Order or Stop-Limit Order.

What are Market, Limit and Stop-Limit orders?

A Market Order or commonly known as a spot transaction, allows you to place a buy or sell order at the current market price. Settlement is immediate and the currency purchased will be credited into your account immediately.

A Limit Order is an instruction to buy or sell a currency at a price you specify. The order will only be executed when the prevailing market price reaches your specified price. It allows you to monitor the market and wait for your preferred pricing in a volatile market.

A Stop-Limit Order is executed when a specified target rate is achieved for the purpose of cutting loss or entry upon conditions being met. A Stop-Limit Order is only executed at the next traded price from the specified target rate.

For FX OrderWatch (Limit and Stop-Limit Orders), instructions placed will expire if the orders are not filled before the expiry date.

Why is there a hold in my debit account after I place a Limit or Stop-Limit Order?

For a Limit Order placed in Citibank eFX - OrderWatch, funds corresponding to the value of your Limit Order will be set aside and held in your debit account (“Hold Balance”). The Hold Balance will be maintained for the duration of the Limit Order and will be released after the order is executed, expired or deleted.

During this time, you will continue to earn interest on the Hold Balance if your debit account is an interest-bearing account. However, you will not be able to access or withdraw your Hold Balance until the hold is released.

Limit and Stop-Limit Orders sound very similar. How are they different?

• Buy Limit Order is placed at or below the current market price.

• Sell Limit Order is placed at or above the current market price.

• Buy Stop-Limit Order is placed at or above the current market price.

• Sell Stop-Limit Order is placed at or below the current market price.

• Sell Stop-Limit Order allows you to create a “floor” for your position to limit losses. For example, the current market rate for USD/SGD is 1.42 and a stop-limit order is placed at 1.40. The order is triggered when USD/SGD falls to 1.40 and becomes a market order that is executed.

In comparison, if a Sell Limit Order is used instead for the same purpose (Order placed at 1.40 when prevailing USD/SGD is 1.42), the Sell Limit Order will be executed instantly at 1.42 since the current market price is above the target price.

How long are my Limit or Stop-Limit orders valid for?

You have the option of setting the expiry period for 24 hours, a week or a month (calendar days). All orders will expire at 9.00am on the expiry date.

If you would like to continue with a lapsed order, you will need to submit a new order.

What are the minimum and maximum amounts allowed for FX transactions?

eFX Market Order (Spot):

Weekday (Mon - Fri)

Minimum trade amount is US$1.00 and maximum trade amount is S$500,000.00 (per day limit)

Weekend (Sat – Sun)

Minimum trade amount is US$1.00 and maximum trade amount is US$25,000.00. Counter rates only.

eFX Order Watch (Limit):

Weekday (Mon – Fri)

Minimum trade amount is US$1.00 and maximum trade amount is S$500,000.00 (per day limit)

Weekend (Sat – Sun)

Minimum trade amount is US$10.00 and maximum trade amount is US$25,000.00. Counter rates only.

How long does it take before I can receive the currency I have purchased?

For Market Orders, upon your trade confirmation, the currency sold will be debited from your account and the new currency purchased will be credited into your Global Foreign Currency account or a new Overnight Deposits account. Limit and Stop-Limit orders are only triggered and fulfilled when the target price has been met.

Please note that orders which are executed during Night Mode (after 11pm) may only be valued in the morning after 9am. Accordingly, your funds may be unavailable until the corresponding holds are released after the limit orders are valued.

Can I make an ATM withdrawal of the currencies in my Overnight Deposits account?

Not directly. To make a withdrawal of your balance in the Overnight Deposits account, you will first need to transfer the balance to a Global Foreign Currency Account or Checking/Saving Account via Citibank Online. You will need to open a Global Foreign Currency Account or Checking/Saving Account if you do not have an existing account. Please note that withdrawal of SGD from Global Foreign Currency Account or Checking/Saving Account using local Citi ATMs will be subject to prevailing exchange rate. Foreign currency withdrawal is not available from local Citi ATMs.

What are the fees or spreads incurred for my eFX transactions?

There are no transaction fees charged but the executed FX rate will be the customer "All in Rate", which is different from the prevailing interbank market rate at the time of the execution as it includes a Bank spread ranging from 0.10% – 1.5% determined by the Bank in its discretion according to the amount placed. For amounts above US$3,000,000, please contact your Relationship Manager directly or call the Treasury Hotline +65 6334 2688.

Can I view my eFX transactions from my monthly statement?

Yes. eFX transactions will appear in the respective debit and credit account in your monthly statement.

Can I view my transactions in the Overnight Deposits account from my monthly statement?

Yes. The Overnight Deposits account will appear in your monthly statement. It is segmented into the different currencies which you hold.

I am unable to select my Checking/Saving account while placing a Limit or Stop-Limit Order. Why?

For Market Orders and Order Watch (Limit and Stop-Limit Orders), these accounts can be used:

• Debit Checking/Saving to Credit Checking/Saving

• Debit Checking/Saving to Credit Overnight Deposits and vice versa

• Debit Overnight Deposits to Credit Overnight Deposits

Disclaimers

The above examples and screenshots are hypothetical and provided for illustrative purpose only. The scenarios are not based on the past performances of foreign currencies. Citibank is not making any prediction of future movements in foreign currencies by virtue of providing the illustrative examples. It does not represent all possible outcomes or describe all possible factors that may affect the payout of a transaction in Citibank eFX.

Any customers using Citibank eFX acknowledge and accept that all transactions they make are made solely upon their judgment and at their discretion and own risk. Nothing in Citibank’s brochures, investment reports and/or any of Citibank’s material supplied to the customer, nor any customer investment profiling conducted for the customer, shall be construed as Citibank’s investment advice as regards the relative attractiveness of one investment option over another. Investors investing in investment and/or treasury products denominated in non-local currency should be aware of the risks of exchange rate fluctuations that may cause a loss of principal when foreign currency is converted back to the investors' home currency. Foreign currency trading is subject to rate fluctuations, which may provide both opportunities and risks. Customers who have any questions about their legal or tax positions as a result of opening an account with Citibank or effecting any transaction on an account with Citibank should engage an independent legal or tax adviser as they consider appropriate.

Exchange controls may apply from time to time to certain foreign currencies. Our Treasury Services Managers and Relationship Managers may assist customers with information on any exchange controls that are relevant to the currencies in which they invest. Placing contingent orders, such as “stop loss” or “stop limit” orders, will not necessarily limit losses to the intended amounts. Market conditions may make it impossible to execute such orders.

Citibank's full disclaimers, terms and conditions apply to individual products and banking services. This communication does not constitute the distribution of any information or the making of any offer of solicitation by anyone in any jurisdiction in which such distribution or offer is not authorized or to any person to whom it is unlawful to distribute such document or to make any offer or solicitation.

This website is not, and should not be construed as, an offer, invitation or solicitation to buy or sell any of the products and services mentioned herein to individuals resident in the European Union, European Economic Area, Switzerland, Guernsey, Jersey, Monaco, San Marino, Vatican, The Isle of Man. the UK, Jamaica, Ecuador or Sri Lanka.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Deposit Insurance Scheme:

Singapore dollar deposits of non-bank depositors are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured. For more information, please visit www.sdic.org.sg.