Issue Cheques

Enjoy the convenience of having a free chequebook, which allows you to make payment to anyone.

Perform ATM Cash Withdrawals

Withdraw cash from over 2.0 million ATMs worldwide with your Citibank Ready Credit Card/ATM Card.

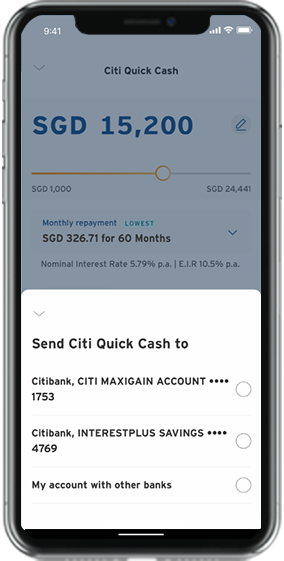

Make an Online Fund Transfer

Transfer funds from your Citibank Ready Credit account to any other bank account anytime, anywhere.

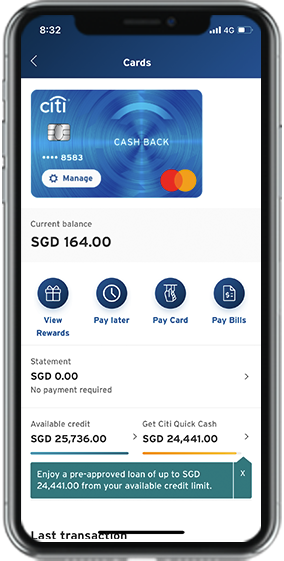

Pay for Purchases

Pay for your purchases at millions of merchants worldwide with the Citibank Ready Credit Card.

Pay for Bills Online

You no longer have to queue up or make trips to different payment counters to pay your bills. With Citibank Ready Credit, you can manage your bill payments online, securely and conveniently.

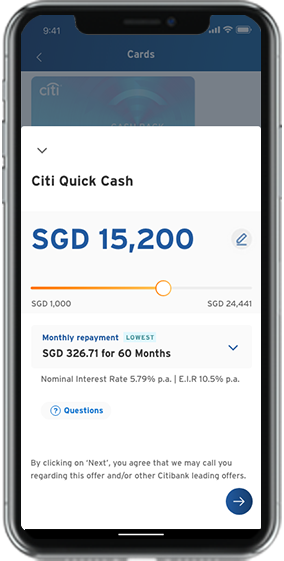

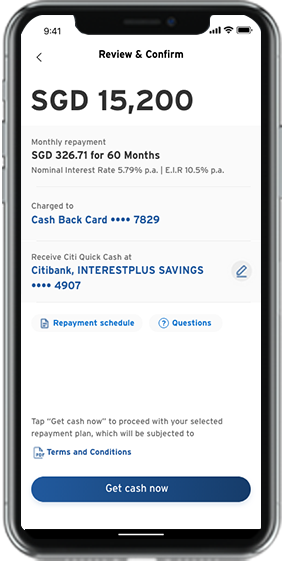

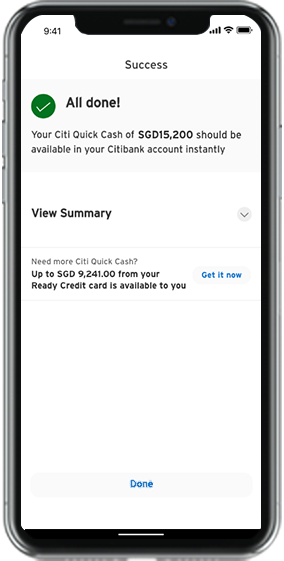

Citi Quick Cash^

Draw a loan on your credit line and repay in fixed monthly instalments over a tenure of your choice: 12, 24, 36, 48 or 60 months.

Contactless Purchases

Speed through the checkout process with your contactless-enabled Citibank Ready Credit Card or mobile phone via Apple Pay/Samsung Pay

- Fast and secure and convenient

- Go cashless

-

Tap to pay with your mobile phone. Find out more

here